Working Papers

Crowding Out Long-Term Corporate Investment: The Role of Long-Term Government Debt Supply [SSRN]

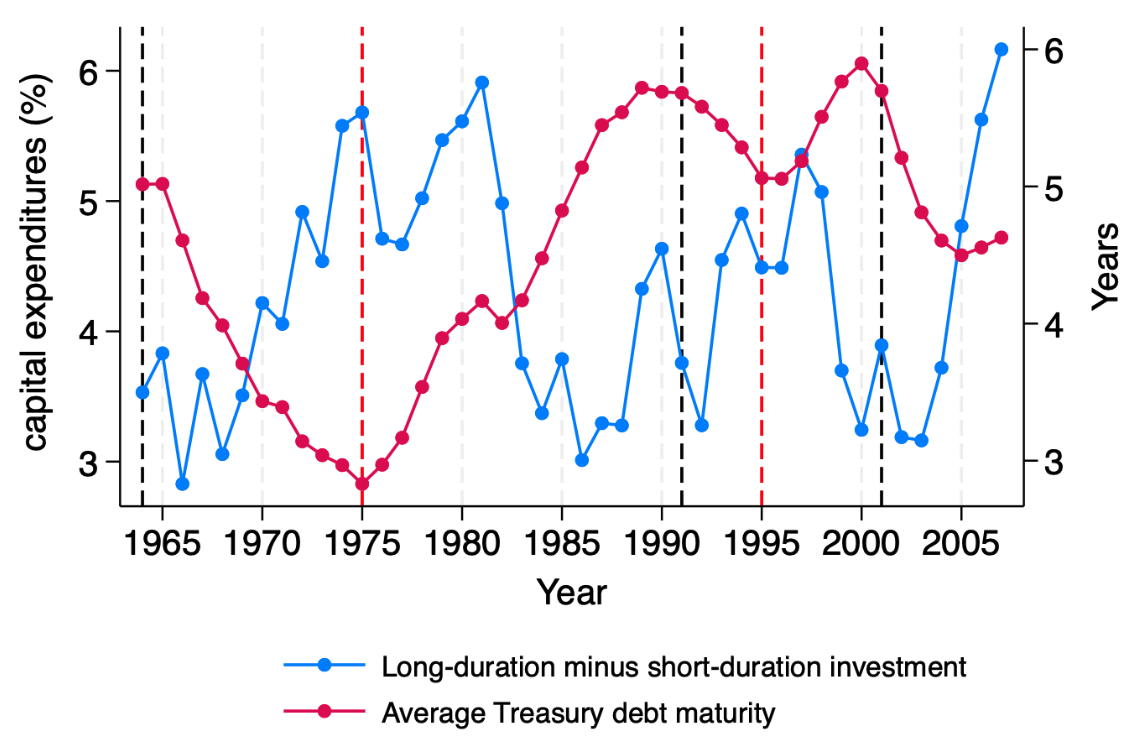

Abstract: Using large, plausibly exogenous shocks to the maturity structure of U.S. government debt, I provide the first causal evidence that the supply of long-term government debt affects the duration of corporate investment. I find that an increase in the supply of long-term government debt increases long-term discount rates, crowding out long-duration investment. This crowding-out effect reallocates capital from long-duration investment towards short-duration investment. This reallocation occurs across industries, within industries across firms, and within firms across divisions. I provide evidence that this reallocation depends on investment duration but is independent of firms' capital structure. Due to the prevalence of asset–liability maturity matching, the resulting variation in aggregate investment duration explains a sizable share of the variation in aggregate corporate debt maturity. My findings imply that policies which influence the net supply of long-term bonds, such as public debt management and central bank quantitative easing or tightening, affect the composition of corporate investment.

Selected presentations: European Summer Symposium in Financial Markets 2025, UIUC Gies, USC Marshall, Cornell SC Johnson, EIEF, LBS, LSE, MIT Sloan, UW-Madison, Chicago Booth, Notre Dame Mendoza, Wharton, OSU Fisher, Boston Fed, NYU Stern, Banque de France Empirical Corporate Finance Workshop 2024, Collège de France, EFA Doctoral Tutorial 2024, SFS Cavalcade 2024, Berkeley Haas, Columbia University, Chicago Booth Treasury Markets Conference 2024, AFA 2024, SED 2023, FIRS 2023, Adam Smith Workshop 2023, MFA 2023, FIFI Conference 2022, FIRS 2022 Ph.D. Student Session.

The Fiscal Cost of Quantitative Easing [SSRN]

with , ,

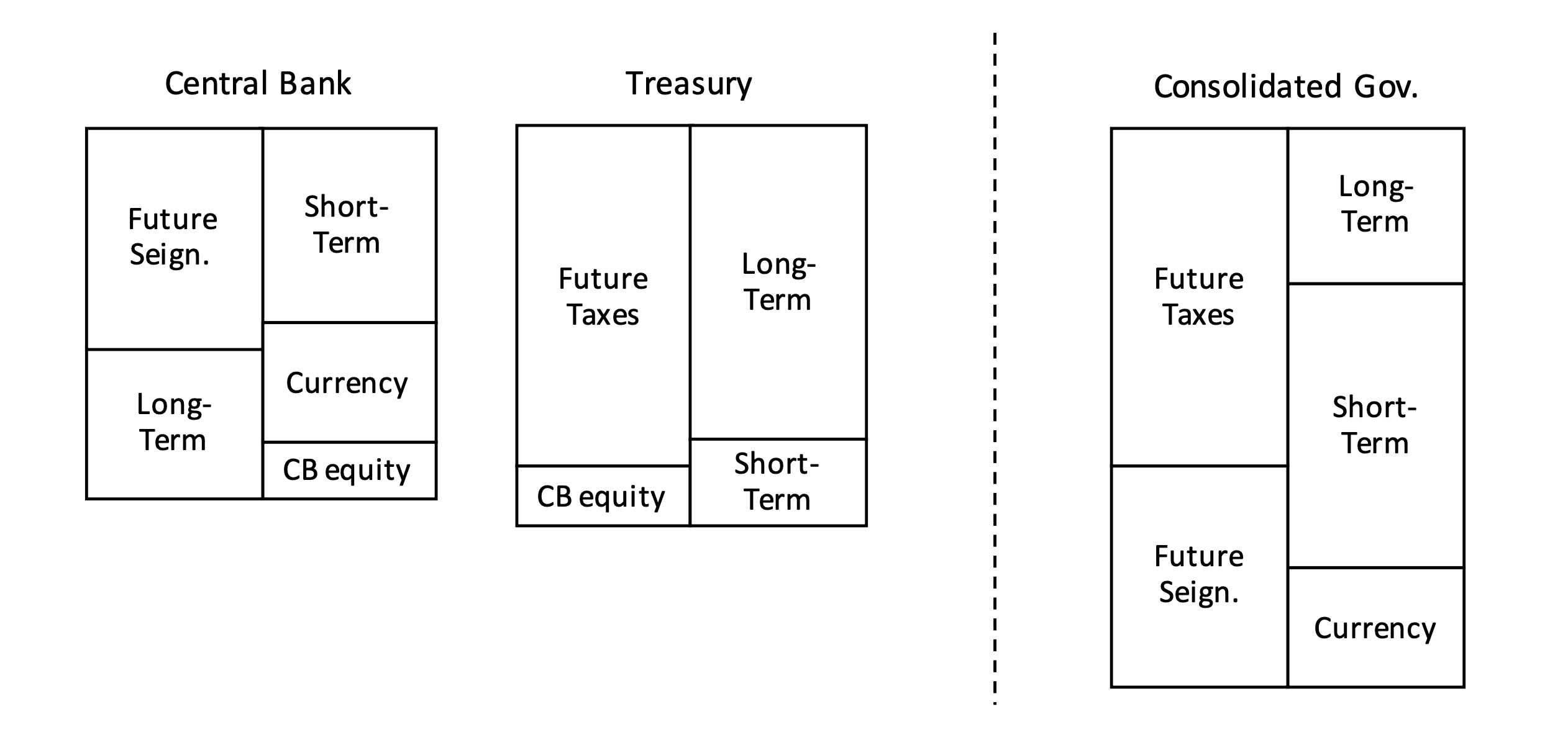

Abstract: This work proposes a framework to study the risk-benefit trade-off of quantitative easing (QE) for the consolidated government, integrating the central bank and treasury department. In a simple model with distortionary taxes, nominal frictions, and a zero lower bound, we characterize the optimal size of a QE program as equalizing the marginal benefit from stimulating output to the marginal cost of induced rollover risk for taxpayers. A conservative quantification of this trade-off suggests that QE programs in the US made a positive net present contribution to welfare.

Selected presentations: Cesifo Macro, Money, and International Finance 2025, WFA 2025, Oxford Saïd-VU SBE Macro-Finance Conference 2025, SFS Cavalcade 2025, Adam Smith Workshop 2025, BEAR Conference 2025, GRETA Sovereign Bond Markets Conference 2025, USC Macro Finance Conference 2025, Stanford SITE 2024.

Loan Spreads and Interest Rates: The Role of The Deposit Channel and Lending Market Power

with

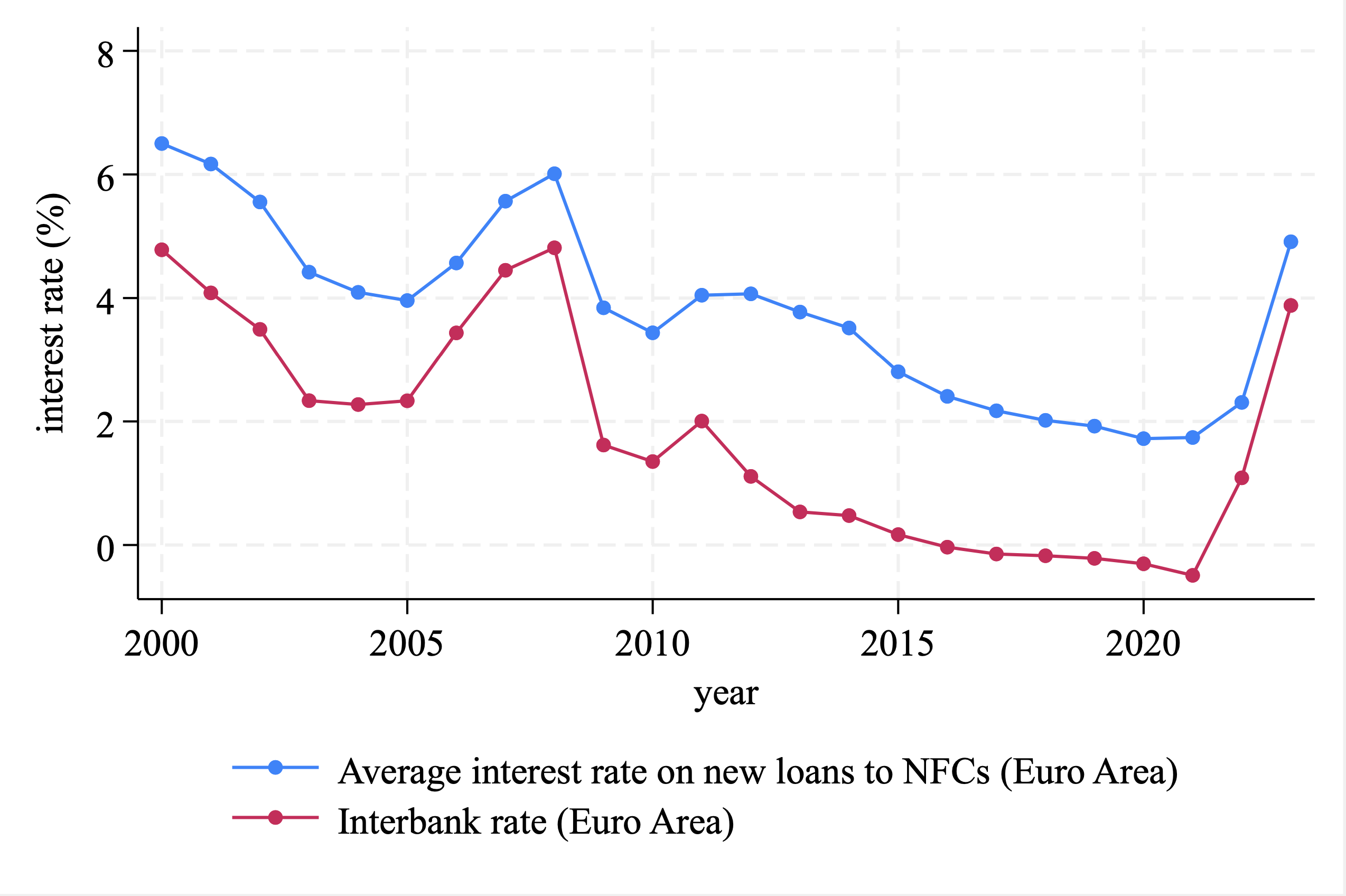

Abstract: We present evidence that loan spreads earned by banks over marketable interest rates are, in the French business lending context, inversely related to the level of short-term interest rates. Controlling for the pricing of credit and interest rate risks, we show that this negative correlation is consistent with a credit supply shock: banks who increase loan spreads more when interest rates decline also experience lower growth in credit supply. We find empirical support for theories that link frictions in the deposit-taking business to lending outcomes of financially constrained banks. Lower rates compress deposit spreads earned by banks, prompting constrained banks to reduce lending, and explaining the rise in loan spreads. We also find support for a complementary channel, lending market power. Specifically, lenders with higher market share and borrowers facing a higher "hold-up problem" are associated with a lower interest rate pass-through. Finally, we provide novel evidence of negative real effects on corporate financing and investment for firms borrowing from banks with lower interest rate pass-through.

Selected presentations: FIRS 2025.